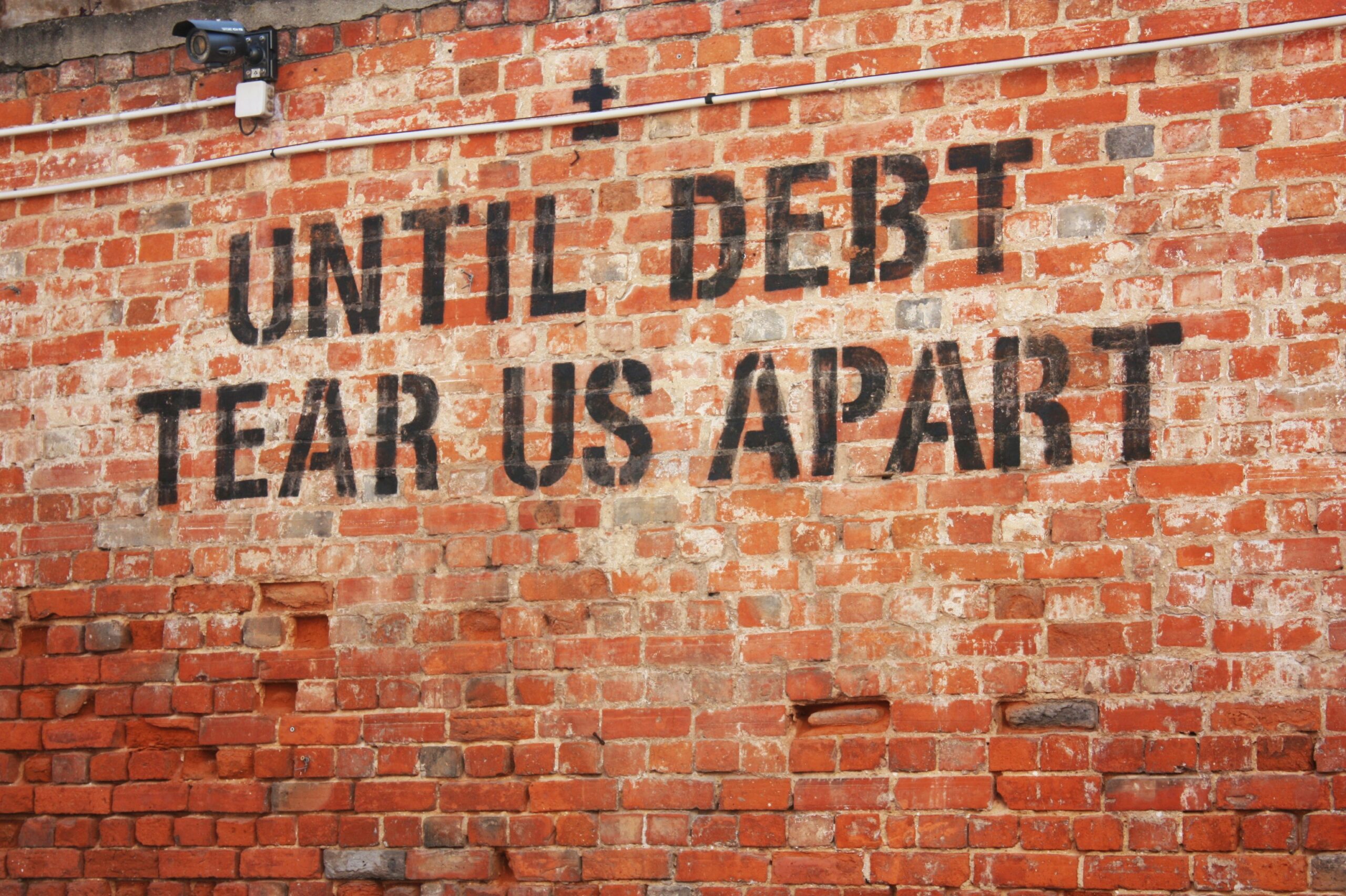

The world’s collective debt has surged to an unprecedented $313 trillion, according to a recent analysis by the Institute of International Finance (IIF), marking a significant increase as governments and corporations grapple with persistent inflation and elevated interest rates. This staggering figure, released Friday, underscores growing fiscal fragility across global markets, raising concerns among central banks and financial regulators about sustainability and future economic stability.

The rapid accumulation, which saw global debt grow by over $15.5 trillion in the latter half of 2023 alone, is primarily driven by persistent borrowing from major economies, including the United States, China, and emerging markets. Unlike the debt crises of previous decades, the current surge is marked by high commercial real estate risk exposure and a burgeoning vulnerability within the shadow banking sector—financial intermediaries outside traditional banking regulations. This shift means that risks are now more diffused and potentially less visible to central oversight.

Developed Economies Lead the Borrowing Spree

Developed nations accounted for the lion’s share of the increase, adding a net $11.6 trillion to global debt in the second half of last year. Their robust borrowing activities have been necessitated by several factors: post-pandemic recovery spending, vast energy transition investments, and rising costs associated with aging populations and social security obligations.

China, meanwhile, continues its trajectory of substantial borrowing, with its debt-to-GDP ratio reaching new peaks. While Beijing attempts to stimulate a slowing economy, the sheer scale of borrowing across its provincial and corporate sectors has become a major source of global financial instability, particularly concerning the troubled property development industry.

Emerging Market Resilience Tested

Emerging market nations also saw their cumulative debt climb, surpassing $105 trillion. However, the IIF noted a stark divergence within this group. Countries with diversified export bases and robust domestic consumption, such as Brazil and India, have demonstrated greater resilience, largely avoiding significant sovereign debt crises despite challenging global conditions. Conversely, nations dependent on commodity exports or struggling with political instability face mounting refinancing risks as borrowing costs remain high globally.

The pervasive increase in interest rates implemented by central banks to combat multi-decade high inflation is compounding the challenge. Higher rates translate directly into larger debt servicing costs, diverting national budgets away from crucial public investments like healthcare and education. This situation is particularly acute for countries where a substantial portion of their debt is denominated in strong currencies like the US dollar.

Navigating the High-Debt Environment

The report emphasizes that while global economic growth has remained surprisingly resilient, the fundamental risk posed by this record debt load cannot be ignored. The potential for a sharp slowdown could trigger a wave of corporate defaults, especially within the non-bank financial sector, which has grown rapidly and often operates with less capital reserve scrutiny.

Key Takeaways for Policy Makers:

- Fiscal Prudence: Governments must prioritize credible long-term fiscal consolidation plans to anchor expectations and reduce market volatility.

- Shadow Banking Oversight: Increased regulatory attention is needed for non-bank financial firms to mitigate systemic risk.

- Debt Sustainability Focus: International financial institutions must intensify efforts to support vulnerable emerging economies through structured debt relief and refinancing mechanisms.

Managing the $313 trillion overhang requires a nuanced approach, blending targeted economic stimulus with strict fiscal discipline. As central banks across the globe tentatively prepare for potential rate cuts later this year, the success of these policy pivots will largely determine whether this record debt mountain becomes a catalyst for global economic slowdown or merely a persistent structural challenge. Without carefully coordinated international policy responses, the financial landscape remains vulnerable to the slightest economic shock.