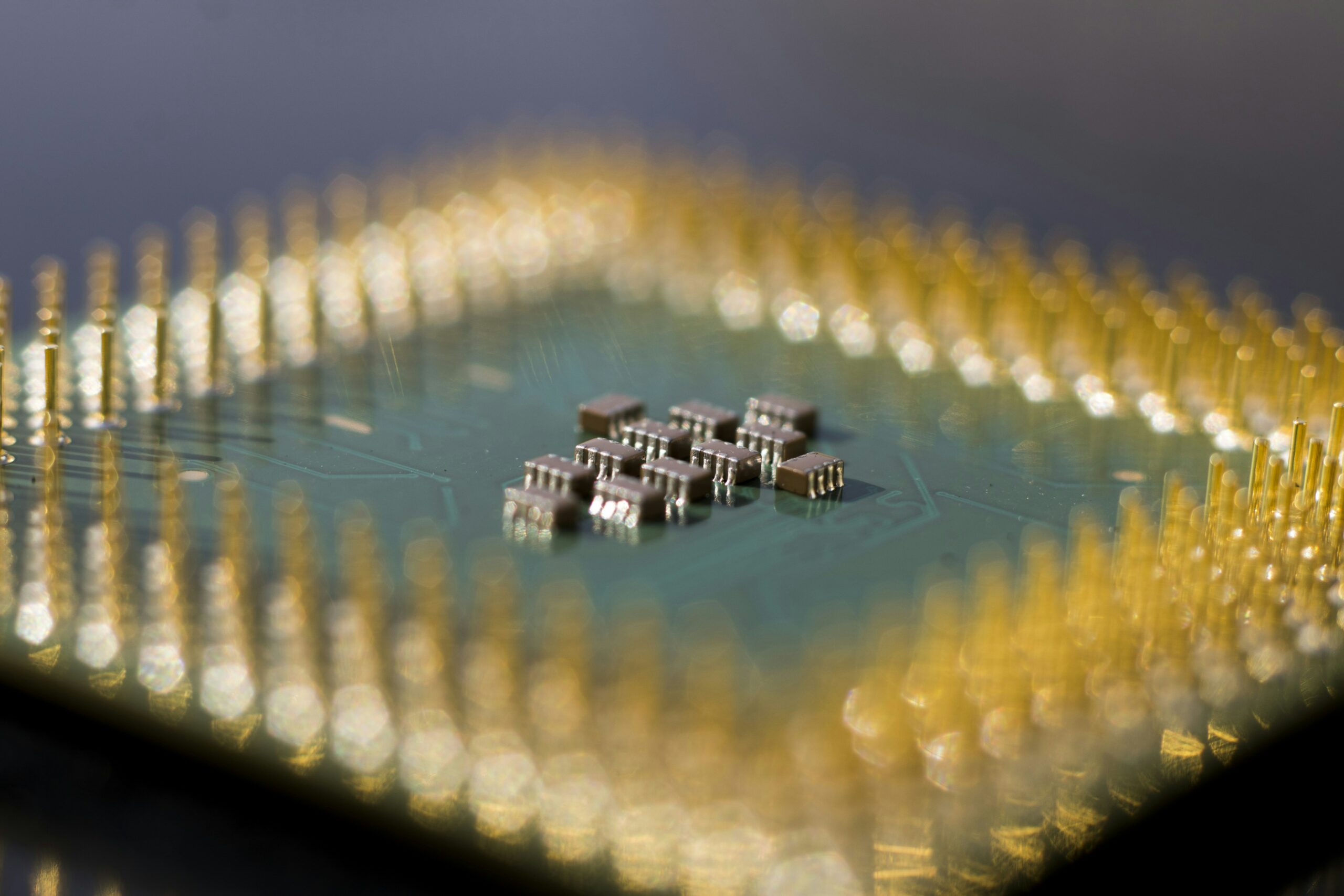

The worldwide shortage of semiconductor chips, critical components for nearly all modern electronic devices, continues to stifle global manufacturing, impacting everything from major automotive lines to consumer appliances and personal electronics. Driven by a volatile mix of surging pandemic-era demand, supply chain bottlenecks, and geopolitical tensions, the scarcity has forced companies to delay product releases and leave billions of dollars in potential revenue on the table. Experts predict that while some sectors may see marginal relief, significant resolution for the tight supply is unlikely before the end of next year, keeping inflationary pressures high and forcing consumers to pay more for fewer choices.

Roots of the Semiconductor Crisis

The current crisis is not singular but a culmination of several intertwined events. When the COVID-19 pandemic first accelerated in 2020, manufacturers drastically reduced orders for chips, anticipating a global economic slowdown. Simultaneously, however, the shift to remote work and distance learning triggered an unprecedented boom in demand for computers, servers, and networking equipment, depleting existing stockpiles.

Furthermore, modern vehicles increasingly rely on sophisticated electronics, with the average car now utilizing hundreds of chips for safety, engine management, and infotainment systems. As the automotive sector rebounded faster than anticipated in mid-2021, it found itself at the back of the queue, trailing behind powerful consumer electronics giants like smartphone makers.

Manufacturing limitations are also a persistent constraint. Chip fabrication facilities, known as foundries, require years and billions of dollars to build and bring online. The overwhelming majority of the world’s most advanced chips are produced by a handful of companies, predominantly in East Asia, creating a significant geographical concentration risk.

Economic Fallout and Consumer Impact

The financial ramifications of the shortage are staggering. The technology research firm Gartner estimates that the supply shortfall could cost various industries hundreds of billions of dollars globally. For the consumer, this translates directly into higher prices and limited availability. Waiting lists for new vehicles have grown significantly, and prices for used cars have soared as a result. High-end graphic cards for gaming computers, for example, have sometimes retailed for double their suggested price.

“This is fundamentally a capacity mismatch,” explained Dr. Evelyn Reed, an economist specializing in global manufacturing chains. “Demand has accelerated exponentially faster than the infrastructure required to produce the components has been able to match. It’s forcing a painful re-evaluation of long-term sourcing strategies.”

Key industries affected include:

- Automotive: Production cuts numbering millions of units worldwide.

- Consumer Electronics: Delays in launches of new smartphones, gaming consoles, and laptops.

- Industrial Machinery: Slower deployment of critical infrastructure like 5G networks and medical devices.

Strategic Shifts and Future Resilience

In response, major economies are now prioritizing domestic chip fabrication to enhance supply chain resilience. Both the United States and the European Union have introduced significant legislative and financial initiatives aimed at funding the construction of new large-scale foundries within their borders.

The EU’s proposed European Chips Act seeks to mobilize over €43 billion in public and private investment to boost Europe’s market share in semiconductor production from 10% to 20% by 2030. Similarly, the US CHIPS and Science Act commits significant funding to domestic production incentives and research.

While these investments are crucial for long-term security, they offer no immediate fix. The lead time for new fabrication plants means production capacity from these nascent efforts will only begin to significantly contribute to the global supply after 2025.

Industry projections indicate that the supply-demand imbalance will likely ease in late 2024 as existing foundry expansions, commissioned during the height of the crisis, finally become operational. However, the world will remain sensitive to geopolitical instability, keeping supply chains fragile and underlining the necessity for diversified manufacturing beyond current hubs. Consumers should anticipate continued price volatility and supply constraints until these new capacity increases mature.